How to Become a Cash Flow Engineer for Your Customers

Want to add meaningful and measurable value to your customers? Become a cash flow engineer.

Want to add meaningful and measurable value to your customers? Become a cash flow engineer.

We’ve been told for years that the best way to add long term value to customers is to be consultative or to sell solutions, and I don’t disagree—but it’s no longer enough. The problem is that these terms start becoming vague clichés—and since there is no commonly agreed definition anyone can claim to be a consultative salesperson. The result is that customer and prospects become jaded and easily dismiss any such claims.

Cash flow engineering: it’s a new term and a new approach which is different and concrete. It will allow you to get your buyer’s attention—and deliver on that promise.

Why is cash flow so important to your customers?

A simple yet powerful model for understanding your customer’s business is to see it as a huge engine for generating cash. Cash is the central ingredient of any business operation—it is the enabler and the ultimate objective of all business activity. Every business uses cash to generate more cash.

Although management pundits may disagree, investors know the truth: a company’s principal mission in life is to generate cash for its owners. That’s why visionaries invent and investors invest. Only through generating cash will the company be able to dole out dividends to investors, pay salaries, or grow the business.

In effect, the entire infrastructure of the business, the legions of employees, the business processes, and all that the enterprise comprises is a vast cash generating engine. In order to understand how the business functions, you must be able to trace the cash flows through the engine.

Most importantly, the business decision-makers you sell to pay close attention to it. The key, therefore, to improving the business is to understand how the engine operates, and what it needs to run strong, lean and fast.

Think of yourself as a cash flow engineer for a temperamental race car. Keeping the engine running is important, but you are also constantly searching for ways to squeeze better performance out of it to put the drivers in the best position to win. If you understand how their engine works and suggest concrete improvements that improve the engine, then you are adding real measurable value

Your customer’s cash flow engine

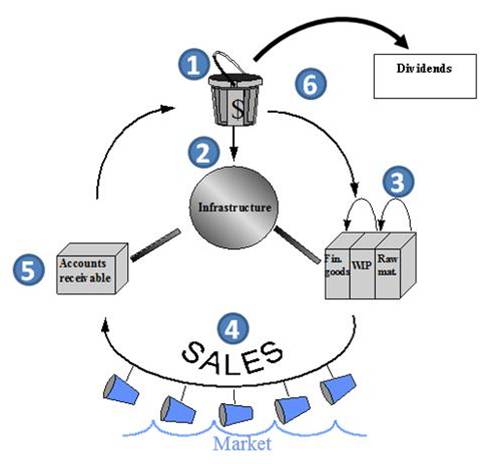

Let’s see how the engine works:

1. Assume that the firm has just been formed. For the moment, its only asset is a great big “bucket” of cash.

2. The only problem with this bucket is that it leaks. Cash is being rapidly sucked out of the bucket by a part of the engine called infrastructure comprising such things as machines, office buildings and equipment, and administrative staff.

3. In order to refill the bucket, you will buy or produce inventory for sale to the market. This is not a trivial process. Yu must acquire raw materials, process it to create finished goods, store it, keep track of it, etc. Every one of the processes takes cash and time, and every dollar that remains in one of these piles is one that is not being cycled through to generate more cash.

4. Next, the inventory must be sold. Unless it is a busy retail operation, this also takes time. As you well know, complex systems sales can have a frustratingly long sales cycle.

5. Once the goods are delivered, the company must still wait for customers to pay. Often, just compiling the information to prepare a proper bill takes time, as does the printing and mailing. Until then all they have to show for their efforts is accounts receivable, which you can’t spend at the grocery store.

6. At last, the cash begins to flow back in to the bucket. Even though you had to leave a lot along the way, in the form of inventory reserves and unpaid receivables, the cash flow engine is beginning to do its job. Cash flows back into the bucket and can then be reinvested into the cycle to generate yet more cash, or to pay dividends. Note that I did not use the word “profit”; profit is not real, it’s only an accounting convention. Cash is real—you either have it or you don’t.

5 ways to engineer more cash flow

Every time the engine turns over, it generates cash. Cash flow improvements come from making the engine more powerful, leaner, or faster. When you look at it this way, you will see that there are five main ways to generate measurable cash flow impact.[1]

More powerful:

- Make the engine bigger: Increase the volume running through it by increasing production or making their products more attractive.

- Increase the size of the buckets: Increase the gross profit margin.

Leaner:

- Reduce the amount taken out: Lower costs.

- Reduce the amount needed to run it: Improve asset efficiency.

Faster:

- Make the engine run faster: Speed up parts or the entire cycle.

Seeing your customer’s business operations this way expands the range of possible improvements beyond saving money and increasing revenues; this allows you to connect with a broader variety of “problem owners” and speak in the terms that they care about. Of course, every engine is different and it takes time and effort to know enough about each one to make a real difference.

Sales pitch for my book

Here’s where I drop the other shoe. This article has had to vastly simplify the idea of the cash flow engine, and of course the devil is in the details. If you want to improve your own cash flow engine, you can learn the details in the new revised and expanded edition of my book, Bottom-Line Selling: The Sales Professional’s Guide to Improving Customer Profits. Or, if you want to try before you buy, you can get a free copy of Chapter 7, which explains the cash flow engine in detail, here.

[1] There are other important benefits you can bring to your customers besides these, of course, but they are much less tangible.

Jack, this is a great analysis. I’ll be buying the book this weekend. Understanding cash flow is a much more powerful sales tool than trying to figure out an ROI argument.

Andy